company tax computation format malaysia 2017

Use the editor to format your answer. 6 to 30 characters long.

Effective Tax Rate Formula Calculator Excel Template

As filed with the Securities and Exchange Commission on August 1 2022.

. Example A trader who is registered in GST takes services of Goods Transport Agency GTA for Rs. Goods and Services Tax - GSTNB enables Functionality for Tax Payers in GST Portal wef 16082022 related to CORE Amendment Link For Taxpayers who fail To Update Bank account Changes in HSN length validation in Form GSTR-1 HSN based validation in Form GSTR-9 Generation of GSTR-11 based on GSTR-1 and GSTR- 5 for UIN holders and Updation of. All our papers are written from scratch thus producing 100.

In the computation of duty on entries ad valorem rates shall be applied to the values in even dollars fractional parts of a dollar less than 50 cents being disregarded and 50 cents or more being considered as 1 with all merchandise in the same invoice subject to the same rate of duty to be treated as a unit. Parsons Corporation acquires all of the assets and liabilities of Sonata Company at the beginning of 2017 in an acquisition reported as a merger. However such GST paid is also allowed as Input tax credit in same month and therefore net liability of tax will not increase.

Of Gujarat directs undertaking of partial audit assessment us 92 of Central Sales Tax Act 1956 rw Section 34 of Gujarat VAT Act for FY. The information in firms. My support is about THB 30000 per month from family friends.

01 Section 16011-1 of the Income Tax Regulations and 316011a-7 of the Employment Taxes and Collection of Income Tax at Source Regulations Employment Tax Regulations provide that each return required under the regulations together with any prescribed copies or supporting data must be filled in and disposed of in accordance with. There seems to be no agreed taxonomy for climate-related risks. This service is listed under the reverse charge list therefore trader has to pay tax 18 on Rs.

This research surveys 839 companies listed on the Australian Stock Exchange for the presence of climate. Must contain at least 4 different symbols. Management of climate risk.

Review your writers samples. 143 and the least important is rumours Average. The average importance of each of the 14 attribute along with the standard deviations is computed and presented in Table 1It can be seen that the most important attribute for investment to the investors is Past performance of firms stock Average.

Climate risk disclosures represents a new resource for identifying the priorities and strategies of Australian companies. Should I open a tax file pay taxes here in Thailand cos my lawyer told me that volunteers do not open tax file. The Cinci Company issues 100000 10 bonds at 103 on October 1 2020.

I have closed my tax file in Malaysia when I relocated to Thailand. FREE formatting APA MLA Harvard ChicagoTurabian 24x7 support. Import Tariff value of Gold increased from USD 55810 grams to USD 57010 grams and that of silver increased from USD 568 kilogram to USD 577 kilogram.

Miguel de Serpa Soares the Under-Secretary-General and United Nations Legal Counsel. We would like to show you a description here but the site wont allow us. I have a volunteer visa for past 10 years and had never open a tax file.

ASCII characters only characters found on a standard US keyboard. The company was listed in Bursa Malaysia since 2010 with 45000000 units of. As a company we try as much as possible to ensure all orders are plagiarism free.

Corporate Income Tax Cit Due Dates

Ctos Lhdn E Filing Guide For Clueless Employees

Deferred Tax Asset Journal Entry How To Recognize

Transfer Pricing Resume Samples Velvet Jobs

Starting And Running Your Freelance Accounting Business Upwork

15 Key Steps To Set Up A Charity

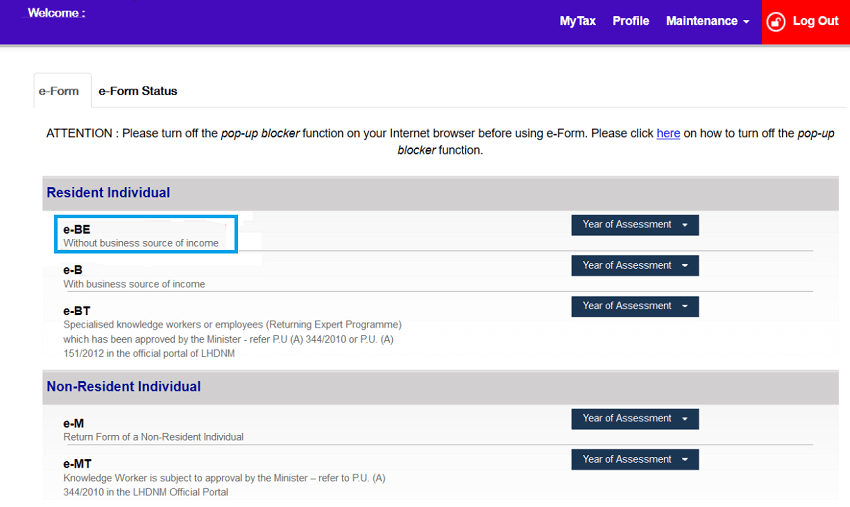

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Taxes From A To Z 2017 O Is For Over The Counter Medicines

2021 Co2 Targets Would Generate 34 Billion Euros In Penalty Payments Within Europe Jato

15 Key Steps To Set Up A Charity

Deferred Tax Asset Journal Entry How To Recognize

Effective Tax Rate Formula Calculator Excel Template

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Sweden Heads The Best Countries For Business For 2017

Ctos Lhdn E Filing Guide For Clueless Employees

Mileage Log Template Free Excel And Pdf Template With Download

Pdf Identifying The Entrepreneurial Success Factors And The Performance Of Women Owned Businesses In Pakistan The Moderating Role Of National Culture

No comments for "company tax computation format malaysia 2017"

Post a Comment